I recently learned that political polls have over time become more and more unreliable. People participating in polls has been decreasing significantly. I mean seriously, when was the last time you answered a political poll? Personally, I never had the pleasure. There has, however, been a shift away from polls and towards a market-based approach.

Baby Billionaire: Shayne Copland

https://www.thestreet.com/.image/t_share/MjE4MzA3MTE4NTk4NDY1MTI2/shayne-coplan.jpg

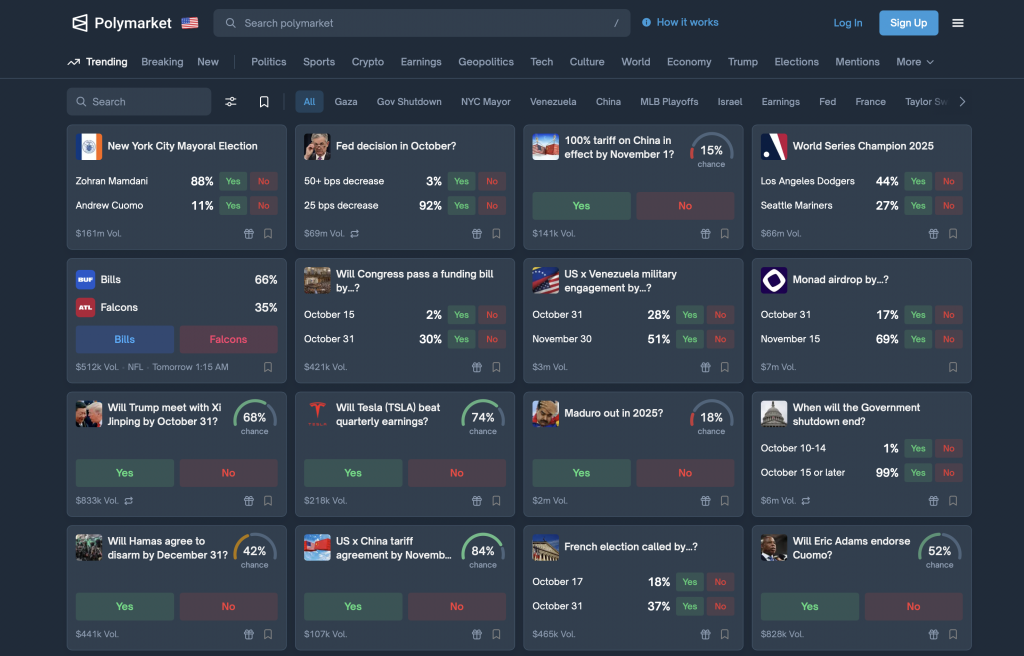

Meet Shayne Coplan , the youngest self-made billionaire at 27. You might be wondering what remarkable contribution he made for the world to value him as one of its wealthiest people. Well, he created Polymarket. Polymarket is essentially a crypto-based betting platform where users can place wagers on a variety of different categories.

Here is what you are greeted with when you first open the website. As you can see, we are currently looking at the trendiest bets. What’s astonishing is the sheer amount of money circulating on this platform.

I used the total trade volume filter, and here are currently the biggest bets on the website. I’m not surprised that the Super Bowl and F1 sports events are at the top, but what piqued my interest is that political bets are also massive.

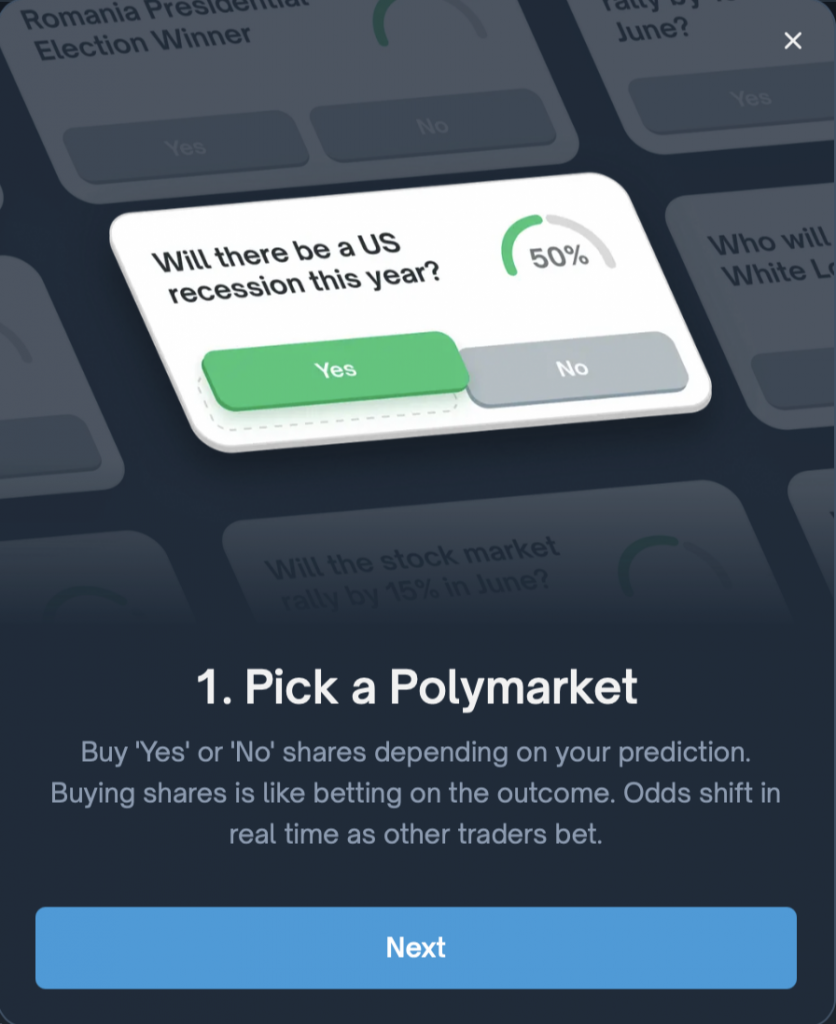

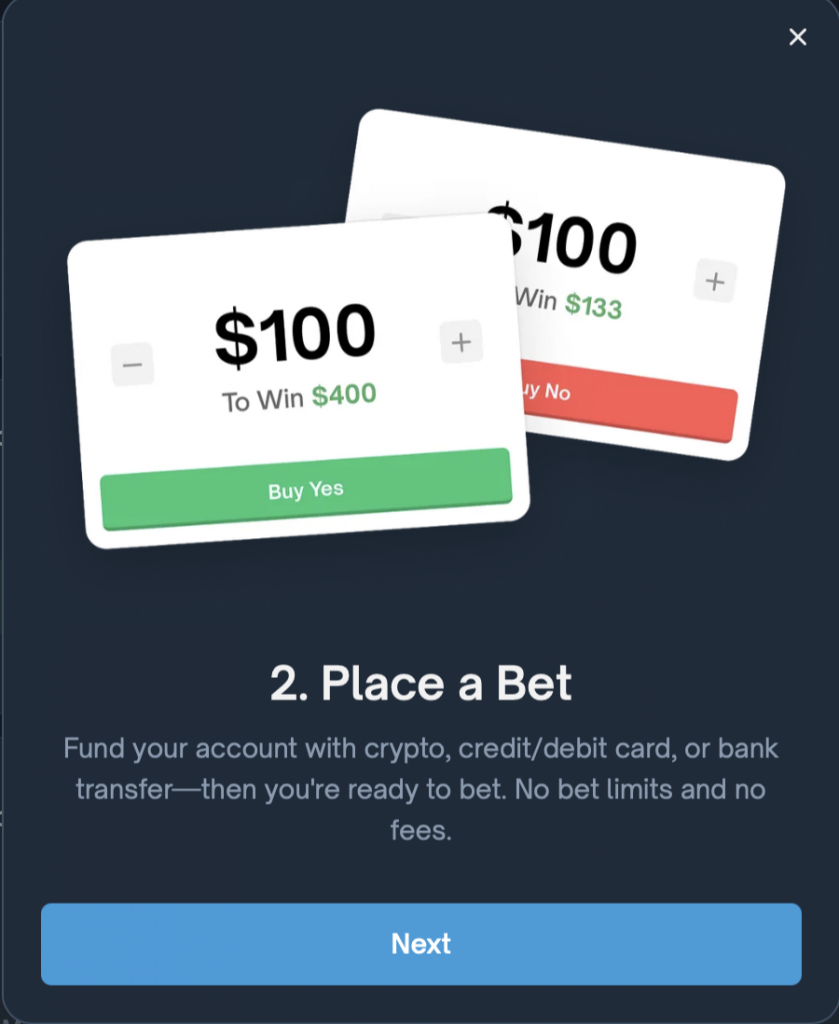

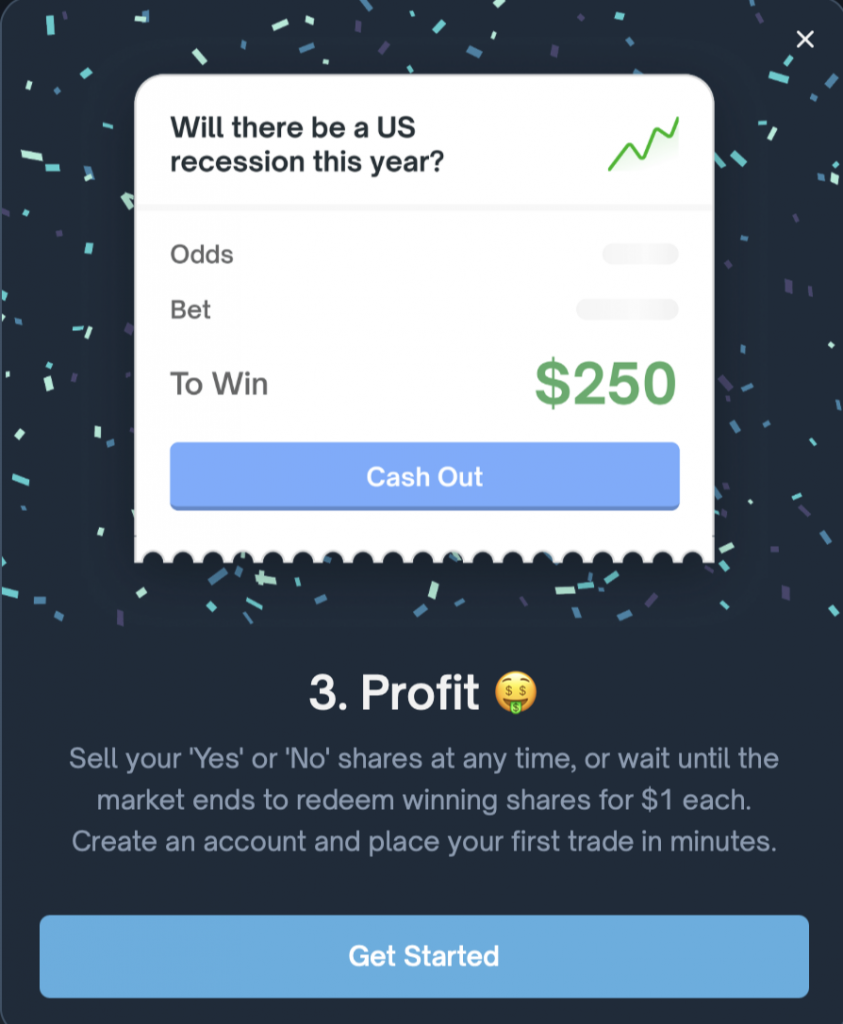

This is how it works… Polymarket explains it in 3 simple steps:

Step 1: Choose a market. Maybe, you think you have some niche knowledge that will make you some money!

Step 2: Adding money (crypto) to your wallet and place a bet.

Step 3: Either wait to see if your bet was correct, or sell your position.

What makes it especially interesting for me is that you don’t have to be right strictly about the outcome to turn a profit. The genius of the platform is that it allows both speculative traders who buy and sell based on price changes and those who hold until resolution. For example, if I make a bet today worth $5 and tomorrow it doubles, I can either sell or hold my position. Polymarket accommodates both trading strategies.

Implications:

Markets factor in all available information, even insider information. This is a big issue here because insider trading regulation cannot be applied to Polymarket as it isn’t regulated by an institution like the SEC. Moreover, people involved in these bets can rig outcomes and make a lot of money. For example, if people bet on me falling down the stairs at Lipsius, and most people say I won’t, I could bet on myself falling and then actually stumble down the stairwell knowing I made a few million.

The legality of this operation is questionable, but the payout system is quite interesting. Firstly, Polymarket operates out of Anguilla to avoid the U.S. Commodity Futures Trading Commission (CFTC). Secondly, they use crypto because it’s technically not money. Thirdly, they aren’t registered; they operate using code.

UMA Optimistic Oracle is how Polymarket figures out what actually happened in the real world. When an event ends, say “Did the Fed raise rates?”, someone submits the answer (Yes or No) to the oracle. Then the oracle waits a day. If no one disputes, that answer is accepted automatically. If someone disagrees, UMA token holders vote on what’s true. Whoever lied loses money, so people are financially motivated to tell the truth. It’s like a decentralized referee that decides who wins each bet.

I did not know about this website at all. It is so interresting that you could basicaly bet on anything and that this not a webside dedicated only to sports or culture or I don’t know what. I think everything resides in the fact that it does everything to avoid law and regulations. How many loopholes can you use at the same time to make your activity legal haha. I am not a money gambler but I could see that as there is really no limit on what you can bet on some people could get in a lot of trouble if they are addicted or in debt to the platform or both. Also that seams crazy that the outcomes of the bets are not even that official. Thanks for the discovery

Glad we are talking about this…

Polymarket now is also cooperating with X, “marking the beginning of a new era for truth on the internet” as “the next information age won’t be led by legacy media — it will be driven by open, competitive markets (…) designed for truth, built on transparency, and grounded in reality” – that’s what they posted on X.

I am highly sceptical of this whole thing: the internet as the playing field of financial interests in global affairs and politics? I would guess corruption isn’t far off here and we probably know that the people behind this aren’t necessarily scared to push someone down the stairs.

Gambling is a big problem in Australia. Lots of young men think they can win, but they mostly lose. I think it is interesting how this PolyMarket makes people feel as though they are destined to win, because they can always sell the share. But that is not how it works; the market must win. So, while this is a clever system, I think it’s just a further perpetuation of the gambling markets that ruin so many lives back home.

Also, thank you for the visual stimuli showing how this platform operates – I’ve always wondered but didn’t want to involve myself and its actually quite interesting!