Short for financial technology – appertains to any business that makes use of technology to upgrade or automate financial services and techniques. Fintech firms combine technologies, such as AI, blockchain and data science, into the traditional financial category. The dawn of fintech lies, of course, on digitization, which has impacted the financial services industry. Information technology (IT), as we know, has developed so much in a way that other industries or sectors have not. This process paired with the fact that financial services and products are almost solely based on information (and not on physical factors), and almost no physical interaction is required (online payments, stocks trading), has allowed for IT to transform the financial arena. These transformations are due to multiple factors, which will be explained below.

The changing character of IT.

Perhaps the most important factor is the improvement of IT and its ease. Developments like the emergence of big data, internet of things or cloud computing have not only facilitated the automation of existing business processes in companies that provide financial services, but also allow for the creation of new products, services, processes and business prototypes. Examples of the result of this development are crowdfunding platforms, such as Kickstarter, Patreon, GoFundMe and more. With the emergence of these platforms, creators and businesses alike, can secure funding without going to traditional banks and getting loans.

The changing consumer conducts.

As IT has improved, so have we been getting increasingly used to interacting with financial services providers through electronic channels. Why physically go to a bank when you can most likely get what you need with a few clicks? This has forced financial services providers to reconfigure the size and amount of their branches and focus on hybrid client interactions. This is evident with the fact that German banks reduced their number of branches from around 50000 in 1990 to 34045 in 2015.

The changing regulation.

Despite the fact that after the 2008 financial crisis regulation of the financial industry increased almost everywhere, recently there have been countries experimenting with lower entry degrees for fintech start-ups.

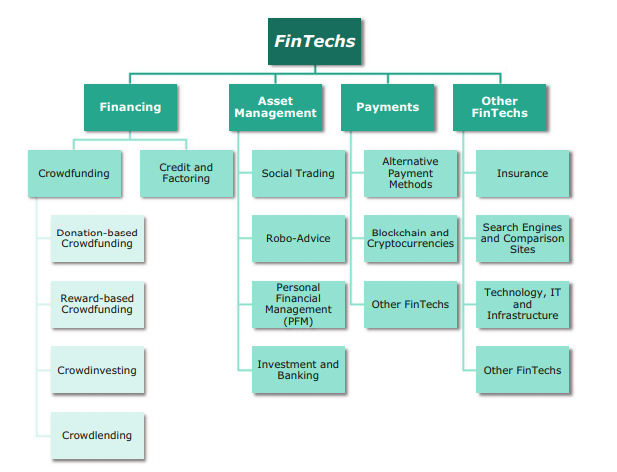

So, what are the uses and examples of fintech right now?

Banking, particularly mobile banking, are a big part of the fintech industry. As previously indicated, consumers would rather have accessible digital access to their bank accounts. Consequently, nowadays I do not know of a single bank that does not provide digital access to its clients. On the other hand, because it has been proven (due to automation and customers’ behaviour) that physical banks are not necessary, neobanks have emerged. Neobanks are banks without any physical branches that provide their customers with payment services, checking, savings, and loans on mobile and digital platforms.

Other examples of fintech are cryptocurrency and blockchain. Although they are considered technologies outside the arena of fintech, the way they work together, are what characterizes them as fintech. Cryptocurrencies enable users to exchange, for example Bitcoins, without any mediators. Blockchain services’ role is to strive to reduce fraud and keep data on the blockchain. Despite the controversies surrounding these services, they are undoubtedly innovative and have helped thousands upon thousands of unbanked people (adults who do not have their own bank accounts) to be able to send and receive money without otherwise high transaction costs.

Other examples are the development of payment methods like Tikkie, Venmo, but also wallets like Apple Pay, Google Pay, PayPal, etc. In the asset management sector, robo-advising, which provides asset suggestions and portfolio management through increased efficiency and lower costs, has been quite groundbreaking too. Lastly, even though the sector of insurance is becoming its own “insurtech”, it also falls under fintech. This industry is finally adopting new technologies by partnering with fintech startups to automate processes and broaden coverage. In the case of health insurance, wearables enable clients and insurances to stay on top of their data and behaviour easily.

Perhaps in the future technology built into our cars will automatically update driving data to our insurance company servers and depending on our driving behaviour our premium will go down or up. What do you think?

Sources:

- Fintech academic article

- Fintech article

I agree with you that IT and finance had a tremendous development in the last decades. But I think that the biggest impact was not in the consumer market but in the capital markets. Huge amounts of capital go around the whole world daily. The automation of the stock market is another development. The It made it possible to create new financial products. Indirectly IT was also responsible for the financial crises we had in this century.

I think that your insurance premium being dependent on your driving behavior is no future, it is already operational and I agree that this development will expand. The car will be able to pay automatically for toll services, the health insurance will also adapt their premiums on your behavior, look what Ahold does with big data and his “bonuscard”. They almost can predict what you will buy the next time you come into their shop.