In the year 2009, Uber was founded in San Francisco by Garett Camp. Now, twelve years later, Uber is valuated at around 91 billion USD and is the biggest provider of mobility service worldwide. Yet Uber has been making big losses and even has at no point in its entire lifespan been profitable. How did Uber become so big, and how is it possible that investors are still believing in the online platform?

The Beginning

In 2008 Garett Camp attended a tech conference in Paris. When he wanted to leave the conference he was unable to find a cab. Already being an experienced entrepreneur, he immediately began thinking of a way to turn this problem into a business opportunity. He came up with an idea to make an app to request taxi rides from your mobile phone. When back in San Francisco he started detailing his plan and founded a company called UberCab a year later. The app was first designed for the use of luxury cabs, but soon it became apparent that this market could be expended to cheap cabs as well. From this point on the service grew rapidly, and the result can be found across the whole world today.

Growing while losing

As discussed in the first Alinea, Uber has never made profit in its years of existence. So how did it manage to grow so quickly? The answer is pretty simple: investments. But why invest in a company that is only making losses? The reason people invest in Uber is because it has almost unlimited potential. Even if Uber is making losses in the moment, with enough investments it is possible that Uber will win the competition for delivering transportation services. In this scenario, Uber will become one of the most important companies on earth and will be worth much more.

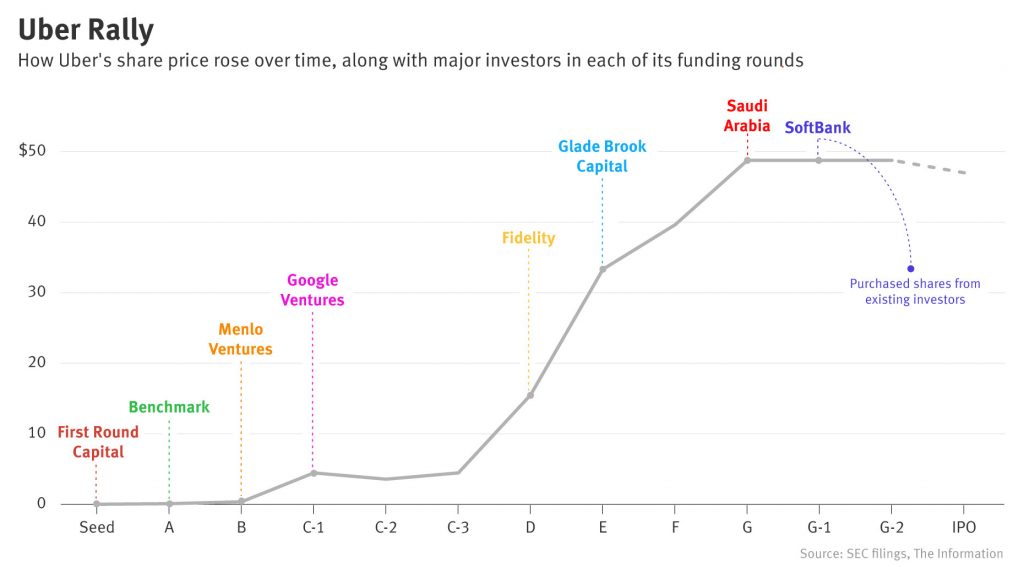

Before Garett Camp founded UberCab he had already founded and sold a startup to Ebay for 75 million USD. This meant for the beginning of UberCab, he could count on his own capital to keep his startup alive. In 2011 the first funding round raised 11 million USD, and saw Uber expand to a few major cities around the globe. The next funding round in the same year gave Uber access in to another 37 million USD: people were starting to believe in Ubers potential. In the next years Uber kept receiving more and more money from investors.

In 2016, Uber became the highest valuated startup in the entire world. This valuation however dropped by almost 20 billion USD when Uber opened up about their financial situation, and the world saw how much losses they had been making. This also caused Uber to have the biggest first day loss when they finally saw their company going to the public market.

Going profitable?

There may soon come an end to the losses Uber is making. Investors are getting tired of not seeing any profit, and the investments are not unconditional. Uber announced they are expecting to make profit in Q4 of this year. They did shed off their very costly autonomous driving car project, and are also putting an end to their experimentation with vertical lift-off aircrafts. Since the start of the pandemic they released 25% of their employees and they have offloaded their bikes and scooters.

However, critic voices say the way Uber is calculating their profits is not excluding a lot of costs. Uber calculates its profits using adjusted EBITDA, a category with 12 units of costs exclusion. Uber is also still facing a lot of problems, like the rising of prices, shortage of drivers, and the upcoming employee status of their drivers in a lot of countries. Still, their predictions are looking positive, so maybe we will one of the fastest growing companies in the last decade actually see making profit sometime.

https://www.ft.com/content/8d118350-ba42-43bb-9300-b81996227f5c

https://www.investopedia.com/articles/personal-finance/111015/story-uber.asp

Recent Comments