The influence that the tech giants have over our lives is evident; yet, their shady dealings are a lesser-known side of these modern monoliths

Something we see more and more every day is the reality of how the digital world is all-pervading: affecting our money, creating our jobs and increasingly providing the foundations of the infrastructure of how we live. Yet, what occurs in the space where the digital and material worlds intersect can sometimes appear to be shrouded in a cloak of impenetrable jargon. Lost in the ether.

So when problems arise, it can be difficult to where to start. Especially, when considering something which is already confusing enough like tax.

Lucrative loopholes litter the world’s economies and it’s not just Big Tech that finds them. All kinds of corporations and conglomerates weasel their way in, fiddle with their finances and pay far far less than their fair share.

But how does this change for companies involved with the digital?

Well, for starters, the full extent to which Google’s ability to alter search results in their favour isn’t fully known; however, their use of ‘filter bubbles’ -designed to personalise search results- remains controversial to some.

What’s Happened: Google Ireland and a Massive Tax Rebate

What influenced me to write about this was actually a news story from Ireland. On the 25th of November, Google Ireland finally agreed that it would pay €218 million to the Irish Government in taxes it should have paid in 2020. This brings the total amount of tax the Irish subsidiary of Google would pay for the first year of the Pandemic up to €622 million -€359 million more than in the previous year.

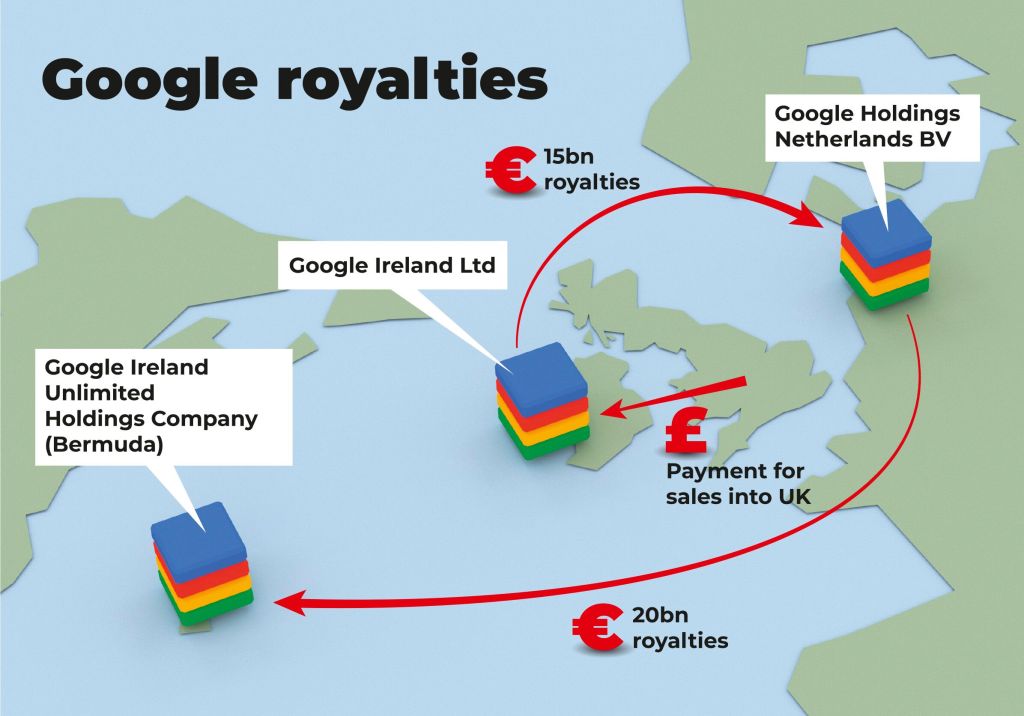

The whole reason Google Ireland were able to do this was through a process called “transfer pricing”.

This is where one division of a company charges another division of the company for goods, services or rights.

It makes up a majority of international trade and in 2016 made up 60% of all global trade.

It’s estimated that the governments of the world lose around $700 billion annually at the expense of individual and corporate transfer pricing and the use of tax havens.

By incorporating this idea into their business model, Google effectively makes its overseas tax rate around 2.4%, according to a Bloomberg investigation.

The decision to pursue Google’s unpaid taxes was influenced by Ireland’s decision to sign up to the OECD (Organisation for Economic Co-operation & Development), an organisation stipulating that members must aim for a minimum corporate tax of 15% by 2023. Before signing, this is what had made Ireland so attractive as a tax haven for large companies.

Is There a Problem?

The considerable problem about this issue concerns the scheme employed by Google to enjoy such benefits.

Called the “Double Irish & Dutch Sandwich”, the scheme involves two Irish companies (one registered in Ireland, one registered in a country with a low or zero corporate tax rate like Bermuda) and a Dutch Shell company (purely for the movement of money).

(Image by The Corperate House of Cards)

As tax is only paid on profits, Google Ireland pay very little in Ireland and the Netherlands and would in practice pay tax in the country of the 2nd Irish company. In this example, it’s based in Bermuda, where the corporate tax rate is 0%, so no tax would be paid at all.

Perhaps the most frustrating part is that everything I’ve just mentioned is 100% legal.

Easy! Now your company pays next to no tax and you can enjoy your swimming pools filled with all of your profit.

What Do We Do Now?

The question we all consider upon hearing this information is “So? What can we do about it!” and it’s a tough question. As it’s profits that are currently taxed, should sales or overall earnings be taxed? That would close some loopholes but pass greater costs onto consumers or small businesses. No government wants to increase prices without direct cause to.

Then maybe instead of changing what is taxed, legislation could be utilised to prevent companies from using such transfer pricing schemes in the first place. Whatever the solution, it’s a much needed one…

In 2019, Google announced that it would be abandoning the double Irish & Dutch Sandwich in an effort to “simplify” its tax arrangements after changes to Irish tax law and Donald Trump’s decision in early 2018 to cut the rate of US corporate tax from 35% to 15.5%. Perhaps in years to come more companies will be forced to step away from transfer pricing but for now -and the foreseeable future- it remains a huge problem.

Resources

2. https://www.youtube.com/watch?v=66ha_vhSJD0

3. https://www.youtube.com/watch?v=JRlndgfIpb4

4. https://www.bloomberg.com/news/articles/2010-10-21/the-tax-haven-thats-saving-google-billions

Recent Comments